Search Results

OUT NOW: Special Issue on Google Shopping in JECLAP

On behalf of JECLAP‘s editorial team, I am proud to announce the publication of the Special Issue dedicated to the General Court’s ruling in Google Shopping.

You can be access it here. Choosing the pieces was not an easy task (we received over 30 submissions in no time), but we could not be more delighted about the end-product.

The contributions are invariably thoughtful and approach the judgment from different angles (some more practical, other more theory-minded). As an editorial team, we are particularly happy that this Special Issue provides a platform to new voices in academia and the world of practice (we are convinced they will become household names in the near future).

If you are curious, below is a glimpse of what the Special Issue offers (I will be discussing some pieces in closer detail in the coming weeks). If (for reasons beyond comprehension) you or your institution are not yet subscribed to JECLAP, you will be pleased to see that some contributions are available in Open Access format.

Enjoy and do not hesitate to contact us and/or the authors with any comments!

Rules, Discretion, and Reasoning According to Law: A Dynamic-Positivist Perspective on Google Shopping (open access), by Justin Lindeboom (Groningen).

The General Court’s Google Shopping Judgment Finetuning the Legal Qualifications and Tests for Platform Abuse, by Friso Bostoen (Leuven).

Bronner revisited: Google Shopping and the Resurrection of Discrimination Under Article 102 TFEU, by Christian Ahlborn, Gerwin Van Gerven and Will Leslie (Linklaters).

Article 102 TFEU, Equal Treatment and Discrimination after Google Shopping, by Lena Hornkohl (Max Planck Institute Luxembourg).

Anticompetitive Effects and Allocation of the Burden of Proof in Article 102 Cases: Lessons from the Google Shopping Case, by Raffaele Di Giovanni Bezzi (European Commission).

Google Shopping and the As-Efficient-Competitor Test: Taking Stock and Looking Ahead (open access), by Germain Gaudin (Freiburg) and Despoina Mantzari (University College London).

Business Models and Incentives: For an Effects-Based Approach of Self-Preferencing?, by Patrice Bougette (Côte d’Azur), Axel Gautier (Liège) and Frédéric Marty (Côte d’Azur).

Between Substance and Autonomy: Finding Legal Certainty in Google Shopping (open access), by Yasmine Bouzoraa (Groningen).

Following the Google Shopping Judgment, Should We Expect a Private Enforcement Action?, by Jeanne Mouton (Côte d’Azur and College of Europe) and Lewis Reed (College of Europe).

Call for abstracts | JECLAP Special Issue on Google Shopping

The Journal of European Competition Law & Practice (of which I am the Joint General Editor alongside Gianni De Stefano) will be publishing a Special Issue devoted to the Google Shopping judgment.

We have already received a number of fascinating proposals, and we would very much welcome more of them. You should email me (P.Ibanez-Colomo@lse.ac.uk) by Friday of next week (3 December) if interested in contributing.

The proposal should take the form of an abstract of max. 250 words in which you outline:

- The aspect of the judgment on which you would like to focus; and

- The contribution your piece is expected to make.

If you submit an abstract, we expect the final article (of around 7,000-10,000 words) to be submitted by mid-January (the idea is to make sure that the Special Issue remains topical). And, as usual, please clarify in your proposal whether you have any conflicts of interests.

We will select abstracts to maximise diversity and balance in the Special Issue. We would be particularly keen to publish new voices and perspectives.

In line with the above, we will be prioritising pieces that add value and enrich our understanding of law, economics and/or policy (and that do so by focusing on one particular aspect or dimension of the judgment).

In the same vein, we will not publish pieces that are eminently descriptive or that amount in essence to a case note covering the various issues raised by the judgment – we would love the Special Issue to work as a coherent whole and to avoid repetition.

We will contact all authors whose abstract has been selected in due course (if there was any doubt, do not hesitate to contact me with any questions, as some of you have already done).

Have a wonderful weekend!

As efficient competitors in Case T‑612/17, Google Shopping: the principle and the conflations

It was inevitable that the Google Shopping judgment would require the General Court to engage with an illustrious principle of the case law: Article 102 TFEU is only concerned with the exclusion of rivals that are as efficient as the dominant firm.

As the Court put it in para 22 of Post Danmark I ‘not every exclusionary effect is necessarily detrimental to competition […]. Competition on the merits may, by definition, lead to the departure from the market or the marginalisation of competitors that are less efficient and so less attractive to consumers from the point of view of, among other things, price, choice, quality or innovation‘.

The corollary to this principle is that only anticompetitive effects that are ‘attributable‘ to the dominant firm’s conduct can trigger the application of Article 102 TFEU. Post Danmark II made an explicit reference to attributability (para 47). Crucially, this point is acknowledged in para 441 of Google Shopping (‘in order to find that Google had abused its dominant position, the Commission had to demonstrate the – at least potential – effects attributable to the impugned conduct of restricting or eliminating competition‘).

Showing that the effects are attributable to the dominant firm’s behaviour (that is, establishing a causal link between the conduct and its impact) demands, by definition, identifying a counterfactual. There is no way around it (I have come to understand that this idea is controversial in some quarters; it is a topic for another post, but I will definitely address it).

The Google Shopping judgment reveals that the principle tends to be conflated with related matters. Two conflations deserve to be discussed:

- The principle is sometimes interpreted as meaning that the Commision (or any other authority or claimant) needs to show that specific rivals are as efficient as the dominant firm. I do not believe that interpretation is correct, and I struggle to find support for it in the case law.

- The principle is occasionally used as synonymous with the ‘as efficient competitor’ test. They are different, and the former should not be reduced to the latter.

The principle in practice: what needs to be proved?

In para 514 of the judgment, the General Court explains that one of the interveners argued that the Commission had not established the anticompetitive effects of the practice as it had ‘failed to show that comparison shopping services competing with Google that had experienced difficulties were as efficient as Google or that they had exerted significant competitive pressure on prices or innovation‘.

The General Court rejects the argument as described above. There seems to be no basis for it in the case law. What cases like Post Danmark I and II demand is that a causal link be established between the practice and the effects. If the effects are not attributable to the dominant firm, but to other factors, then there is no abuse (think by analogy of the ‘failing firm defence’ in merger control).

Put differently: the implementation of the principle demands comparing the conditions of competition with and without the practice. It does not demand, however, establishing the relative relative efficiency of rivals in a reality that has already been ‘contaminated’ by the practice. It would not be possible to establish a causal link in such circumstances.

Suppose that a practice denies rivals a minimum efficient scale. It should not be possible for the dominant firm to then claim that rivals are less efficient and therefore that the practice is not abusive. If such an argument were accepted, then effects that are attributable to the dominant firm’s behaviour would fall outside the scope of Article 102 TFEU. The General Court makes a point along similar lines in para 540.

Instead, the question should rather be whether rivals being denied a minimum efficient scale is attributable to the behaviour of the dominant firm or to other factors. Simply put, the appropriate benchmark should be the world in the absence of the practice.

The principle and the ‘as efficient competitor test’

There is a point in the judgment that is arguably more controversial. In paras 538 and 539, the General Court appears to conflate the principle as described above and the ‘as efficient competitor test’ as used in relation to pricing abuses (such as margin squeezes and rebates).

It is sufficient to read the relevant passages in Post Danmark I (then reiterated in Intel) to realise that the Court of Justice lays down a principle that is broader than the ‘as efficient competitor test’. It is emphasising that exclusion that is not attributable to the dominant firm’s behaviour does not amount to an abuse of a dominant position within the meaning of Article 102 TFUE.

This principle can find many incarnations and can be implemented in a number of ways. The ‘as efficient competitor test’ is just one of them, and one that is particularly apt in relation to price abuses: if it turns out that a ‘margin squeeze’ would not require rivals to sell below cost, any exclusion would not be attributable to the dominant firm, but to the fact that the former are less efficient.

The wording of the judgment, which seemingly conflates principle and test, can be interpreted as meaning that only pricing abuses are concerned with as efficient competitors. According to this interpretation, the principle would not apply to practices such as tying or exclusive dealing. Which takes me to the last point.

Is the principle only relevant for pricing abuses? How could it be so?

According to a current of opinion, the principle laid down in Post Danmark I would indeed only be relevant in relation to pricing abuses. I struggle with this interpretation of the case law, but insofar as it has been debated, it is worth discussing.

There are several reasons why the principle laid down in Post Danmark I is applicable across the board. To begin with, the Court (both in Post Danmark I and Intel) did not confine it to pricing abuses. It was a general pronouncement. What is more, it made an explicit reference to other parameters of competition, namely ‘choice, quality or innovation‘.

The most powerful reason, in any event, is that confining the principle to pricing abuses would lead to outcomes that seem difficult to defend from an intellectual standpoint. Taken to its logical consequences, such an interpretation of Article 102 TFEU would mean that it is necessary to establish a causal link between practice and effects in relation to rebates and mixed bundling, but not in relation to exclusive dealing and tying.

If this interpretation of the case law were accepted, the two sets of practices would be subject to different analytical framework for a purely arbitrary reason (the fact that one set of practices relies on pricing mechanisms) even though they are interchangeable (and have the same object and effect).

I really look forward to your comments on this point (or indeed any of the preceding ones).

The General Court in Case T‑612/17, Google Shopping: the rise of a doctrine of equal treatment in Article 102 TFEU

The General Court’s judgment in Google Shopping (available here) is finally out. There is much to unpack, and much that will be debated in the coming days and weeks. In this regard: the Journal of European Competition Law & Practice is planning a Special Issue devoted to the judgment. More details will follow in due course, but we will be open to proposed submissions, as we want to make sure that the issue is as balanced and diverse as possible.

The above said, it is immediately possible to get a clear idea of the logic underpinning the judgment. It is remarkable in a number of ways, which, if appealed and confirmed by the Court of Justice, may lead to a substantial expansion of the scope of Article 102 TFEU.

The rationale behind the judgment can be summarised as follows:

- The General Court’s develops a principle of equal treatment, which is inferred from the case law applicable to public undertakings (and public bodies) and is now expanded to other dominant firms (para 155).

- There is an element of ‘abnormality’ in the differential treatment of a search engine’s affiliated services, on the one hand, and third party ones, on the other (paras 176, 179 and 616).

- Google’s search engine is a ‘quasi-essential facility’; in any event, it is not necessary to establish that the platform is indispensable within the meaning of the Bronner case law.

Equal treatment, abnormality and competition on the merits

When reading the judgment, one cannot avoid the impression that the General Court viewed the practice at stake in the case as inherently suspicious, that is, as a departure, by its very nature, from competition on the merits. To quote the judgment itself: ‘the promotion on Google’s general results pages of one type of specialised result – its own – over the specialised results of competitors involves a certain form of abnormality‘ (para 176).

The judgment concludes that the behaviour at stake is ‘abnormal’ for two separate reasons.

First, the General Court infers, from the case law, a general principle of ‘equal treatment’, which would demand, also in the context of Article 102 TFEU, that like situations be treated alike unless objectively justified (para 155). This paragraph is remarkable. The Court judgments cited relate to the behaviour of public authorities. The General Court appears to imply that dominant firms are also subject to the same principle (in Deutsche Telekom, the Court of Justice did not go this far, and confined the obligation of equal treatment to instances where the input is indispensable).

It is interesting (in particular for those who study telecommunications regulation) that the General Court refers, in support of its position, to Regulation 2015/2120, which enshrined the principle of network neutrality in the EU legal order. While net neutrality applies to Internet Service Providers, the General Court is of the view that the Regulation ‘cannot be disregarded when analysing the practices of an operator like Google on the downstream market‘ (para 180). Once the principle of neutrality introduced at one level of the value chain, it was bound to be expanded elsewhere (firms that lobbied for net neutrality rules have been reminded in this judgment that we should all be careful what we wish for).

Second, the judgment explains that the conduct is inconsistent with the ‘role and value‘ of a search engine, which, in the words of the General Court ‘lie in its capacity to be open to results from external (third-party) sources and to display these multiple and diverse sources on its general results pages, sources which enrich and enhance the credibility of the search engine as far as the general public is concerned, and enable it to benefit from the network effects and economies of scale that are essential for its development and its subsistence‘ (para 178). In this sense, it is argued, a search engine differs from the infrastructures or input at stake in precedents like Bronner or IMS Health.

Paragraph 178 of the judgment will be discussed at length by commentators. The General Court goes as far as to suggest that favouring the firm’s own services is ‘not necessarily rational‘ for a search engine (or rather, that it is only rational for a dominant firm protected by barriers to entry). Alas, it is sufficient to take a look at the wider world to realise that the conduct at stake in the case is pervasive, even in industries where dominance is rare (such as supermarkets, which, one would assume, are also interested in offering the most attractive products to end-users but have long engaged in similar self-preferencing).

More generally, digital platforms (and search engines are not an exception) are partially open and partially closed. In this sense, the fact that some features in a platform are not open to third parties does not necessarily go against its interests (or is not necessarily irrational). In the same vein, business models evolve, and may become relatively more open (or relatively more closed) over time (think of Apple, which has followed the opposite path).

Indispensability and the Bronner conditions

The General Court also advances two arguments in support of its conclusion that the Bronner conditions (in particular, indispensability) are not applicable in the case.

First, the judgment introduces a doctrine of ‘quasi-essential facilities’. More precisely, the General Court notes that ‘Google’s general results page has characteristics akin to those of an essential facility‘. Even though several judgments are cited (para 224), there are no precedents supporting this position. It is, therefore, an innovation that would need to be confirmed by the Court if the judgment is appealed. It would seem that a facility is ‘quasi-essential’ where it cannot be duplicated (even if not objectively necessary to compete for firms on an adjacent market, which is the crucial consideration).

Second, the General Court engages with the Slovak Telekom judgment, which clarified that indispensability is an element of the legal test where an authority or court would have to ‘force’ a dominant undertaking to deal with third parties with which it has chosen not to deal.

In this regard, the judgment tries to distinguish between a refusal in the traditional sense and the behaviour at stake in the case. However, the General Court seems to concede that formal differences between the two are not decisive. The arguments against requiring indispensability in the case are ultimately drawn from the opinions of the Advocates General in TeliaSonera and Bronner. These opinions are cited (at para 239) in support of the proposition that exclusionary discrimination is a separate form of abuse.

A close look at these opinions shows that only Advocate General Mazak’s analysis in TeliaSonera is capable of substantiating the conclusion drawn from it in the judgment. Advocate General Jacobs’ in Bronner indeed mentions discrimination, but is clearly referring to exploitative conduct and therefore does not answer the question (the same is true, by the way, of the reference to discrimination in Irish Sugar).

In any event, Advocate General Mazak’s Opinion would still fail to address the criterion introduced by the Court in Slovak Telekom: would the key question not be whether intervention forces a firm to deal with rivals? If so, does it matter whether we call it discrimination or otherwise? One should not forget, in this sense, that Slovak Telekom came after the Opinion and that the latter was not followed by the Court in TeliaSonera, which struck a different balance.

The General Court dismisses the idea that a remedy forcing a firm to deal with rivals means that indispensability should be an element of the legal test. It does so in the following terms:

‘244. However, the obligation for an undertaking which is abusively exploiting a dominant position to transfer assets, enter into agreements or give access to its service under non-discriminatory conditions does not necessarily involve the application of the criteria laid down in the judgment of 26 November 1998, Bronner (C‑7/97, EU:C:1998:569). There can be no automatic link between the criteria for the legal classification of the abuse and the corrective measures enabling it to be remedied. Thus, if, in a situation such as that at issue in the case giving rise to the judgment of 26 November 1998, Bronner (C‑7/97, EU:C:1998:569), the undertaking that owned the newspaper home-delivery scheme had not only refused to allow access to its infrastructure, but had also implemented active exclusionary practices that hindered the development of a competing home-delivery scheme or prevented the use of alternative methods of distribution, the criteria for identifying the abuse would have been different. In that situation, it would potentially have been possible for the undertaking penalised to end the abuse by allowing access to its own home-delivery scheme on reasonable and non-discriminatory terms. That would not, however, have meant that the abuse identified would have been only a refusal of access to its home-delivery scheme‘.

Your thoughts on the above would be very much welcome. My impression is that the paragraph fails to engage with the question, which remains unanswered. The General Court explains, in essence, that, in a case like Bronner, the dominant firm may have breached Article 102 TFEU in a different way, and that remedying the additional abuse may or may not have required the firm to deal with third parties (think of an exclusivity obligation). That seems correct and unquestionable.

However, the fact remains that indispensability would have been an element of the legal test in relation to the refusal. Whether or not there might have been an additional abuse does not alter this conclusion. And, as the Court explains in Slovak Telekom, the reason why indispensability would have been an element of the legal test in relation to the refusal is because intervention would interfere with the firm’s freedom of contract and would amount to forcing it to deal with rivals.

The General Court’s interpretation of Slovak Telekom will give rise to some controversy and will be widely discussed. This is only normal, as there is much uncertainty around the meaning of the case law. Paragraph 246 shows the extent to which the relationship between remedy and legal test needs to be clarified. As cases like Bronner show, they are two sides of the same coin: it is artificial to distinguish between both. When pondering whether a refusal to deal should be abusive, we are acutely aware that intervention would involve mandating a firm to deal with rivals (and we are cautious about such a remedy). It is difficult to pretend otherwise.

Since this post is already too long, I will be addressing other questions (in particular in relation to effects) in other entries. If there was any doubt: still nothing to disclose.

The Italian Competition Authority in Enel v Google: will Bronner and Magill survive common carrier antitrust?

Earlier this month, the Italian Competition Authority (AGCM) adopted a remarkable decision, which deserves close attention, in a dispute involving Enel (the Italian incumbent in the electricity sector) and Google. You will find the decision here (in Italian) and a press release (in English) here.

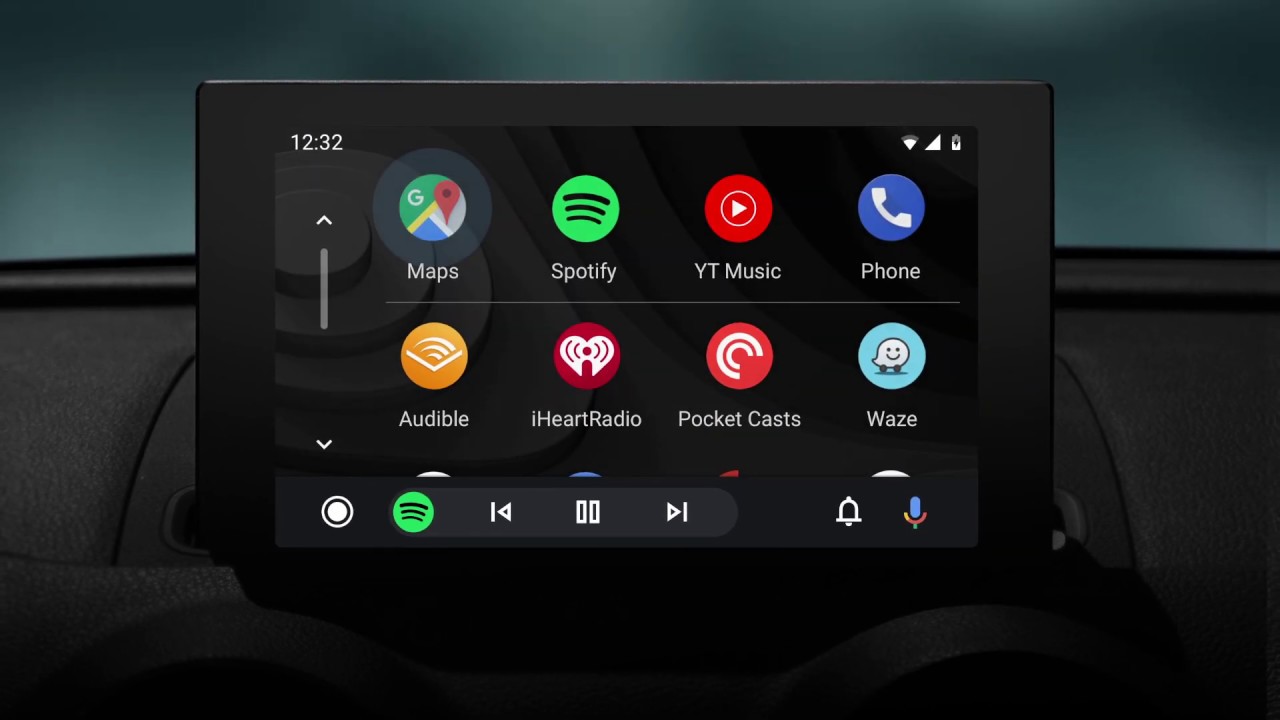

The decision stands out from others in the digital sphere in that it is expressly framed as an outright refusal to deal. While in other cases it is genuinely open to question whether the ‘exceptional circumstances’ tests laid down in Magill and Bronner are applicable, there is no doubt on this point in Enel v Google. The complainant requested access to Android Auto and the authority applies the case law on refusals to deal.

That Magill and Bronner provide the relevant tests is also clear in light of Slovak Telekom. Intervention in Enel v Google amounts to requiring the defendant to redesign its product. On this point, the decision goes beyond an obligation to negotiate access with a would-be rival, which is the typical remedy in a refusal to deal case. The Italian authority has asked Google to release a version that can accommodate the functionalities of Enel’s product.

What is the case about? Android Auto and Enel’s JuicePass

The case is about Android Auto, which is an application that gives access to some of Android’s features on a car’s dashboard. Thus, instead of accessing these features (say, Google Maps) via the smartphone, they can be accessed, more conveniently, via the car’s own display.

Enel’s complaint concerned Google’s refusal to allow one of its applications (JuicePass) to feature on Android Auto. JuicePass provides assistance to drivers of hybrid and electric vehicles: more precisely, the application allows car users to search for charging stations, book charging slots and pay for the electricity.

According to the complaint, Google’s refusal to allow JuicePass into the Android Auto ecosystem amounts to an abuse of a dominant position. The claim raises a number of interesting issues. I will only focus on two of them: whether Android Auto can be said to be indispensable and whether the refusal would result in the elimination of all competition on the adjacent market. These are the two key conditions that are common to Bronner and Magill (and which are notoriously difficult to establish in practice).

Establishing the indispensability in the case would involve showing that it is not possible to compete on an adjacent market without featuring in Android Auto and that there are not any economically viable alternatives to the said application. The elimination of all competition condition, as the law stands, demands evidence of the certainty, or quasi-certainty, of anticompetitive effects absent access.

The reasoning in the decision is interesting in two major respects. First, the adjacent market is never defined by the authority. It identifies a ‘competitive space’ (‘spazio competitivo‘) instead. Second, the interpretation of the indispensability condition is not obvious to square with the definition provided in the case law (in particular IMS Health, which is the most explicit on the point).

This approach, which departs from that followed in Magill and Bronner, seems to mark the comeback of a doctrine of ‘convenient facilities’ (as opposed to essential). If one pays attention to the remedy, on the other hand, it becomes apparent that the decision is unprecedented in another fundamental respect: the duties imposed on Google go beyond an access obligation. These questions are examined in turn.

Indispensability in Enel v Google: towards tailored access to ‘convenient facilities’?

A look at the facts in Enel v Google suggests that access to Android Auto is not indispensable within the meaning of Magill and Bronner. After all, the application (JuicePass) can be readily downloaded and used (and has been readily downloaded and used since it was launched) on smartphones (via both Play and AppStore). Insofar as there are alternatives around Android Auto, a plain reading of the case law would reveal that the indispensability condition is not met.

The Italian authority hints at a different interpretation of the condition. According to the decision, the indispensability element of the test is met because access to JuicePass via smartphone is not comparable to access via Android Auto. This is so, according to the authority, for safety and/or convenience reasons (using JuicePass on the smartphone is said not to be as safe as using the car’s dashboard; and stopping the car to use the application would not be convenient).

It is difficult to square this understanding of the notion of indispensability with Bronner, which makes it explicit that the condition is not met where there are alternatives around an infrastructure, irrespective of whether they are ‘less advantageous’. The decision, in this sense, is indicative of the return of a ‘convenient facilities’ doctrine that would substantially lower the threshold for intervention in refusal to deal cases. Indispensability, under this new approach, means the ability to use apps in an ‘easy and safe way’ (‘in maniera facile e sicura‘).

The passage addressing the remedies suggests that the indispensability condition is also expanded in a different direction: Google has been required to ensure that JuicePass has access on the terms and conditions that Enel deems indispensable. From this perspective, the decision marks a move from an objective understanding of the notion to a subjective interpretation: what is indispensable depends on what each specific firm demands and deems necessary.

Will Bronner and Magill survive common carrier antitrust?

Many disputes in digital markets concern the terms and conditions of access to an input or platform. Therefore, it was only a matter of time before the Bronner and Magill case law would be directly challenged in an outright refusal to deal case: it is not a secret that indispensability is very difficult to establish in practice and thus acts as a limit to how much digital ecosystems can be refashioned by competition authorities.

Given the obvious and substantial tension between the Italian authority’s decision and the relevant case law, there is a chance that the issue is eventually brought before the Court of Justice, which has recently reaffirmed the principles of Bronner and Magill (including the importance of preserving firms’ incentives to invest and innovate) in Slovak Telekom.

It remains to be seen whether the case law, including Magill and Bronner, survives common carrier antitrust. In this regard, it is interesting to note that Enel v Google applies, avant la lettre, some of the concepts underpinning recent legislative proposals (and in particular the notion of gatekeeper). Future law, rather than existing law, appears to drive and shape enforcement. Fascinating times indeed.

As usual, I have nothing to disclose.

Indispensability in Google Shopping: what the Court did, and did not, address in Slovak Telekom

Slovak Telekom was eagerly awaited, to a significant extent, because of its impact on Google Shopping, currently pending before the General Court. The question of whether the legality of the behaviour in the latter should be assessed in light of the Bronner conditions is arguably the most important aspect of the case.

Last month’s judgment provides some valuable clarifications concerning the conditions under which the Bronner conditions apply. A careful and dispassionate assessement of Slovak Telekom reveals, however, that some issues remain open.

It does not seem possible to claim, categorically, that the judgment unequivocally supports one conclusion or the other. Depending on how some open questions are interpreted, both outcomes (i.e. that indispensability is required and that it is not) seem in principle defensible.

What the Court held in Slovak Telekom

Dominant firms are in principle able to engage in self-preferencing: In paras 45-46, the Court holds that, at least in principle, there is nothing inherently abusive in the fact for a dominant firm to develop an infrastructure for its own needs. In particular, it is not unlawful for a dominant firm to favour itself by refusing to conclude an agreement with a rival.

The indispensability and elimination of all competition conditions are required where intervention would force a firm to conclude a contract: In line with the relevant case law since Commercial Solvents (see here) the Court confirms that the Bronner conditions are relevant where intervention would require a firm to conclude a contract (paras 46-47). The applicability of the indispensability and elimination of all competition conditions depends, in other words, on the nature of the remedy required to bring the infringement to an end. If intervention demands a duty to deal with third parties with which the dominant firm had chosen not to deal, the lawfulness of the behaviour would be assessed in light of Bronner.

Freedom of contract and long-term incentives to invest and innovate explain the ruling: The Court is explicit about the reasons why the Bronner conditions are sometimes required. Forcing a firm to conclude a contract interferes with firms’ freedom of contract and their right to property, and should therefore be confined to exceptional circumstances.

Open questions in Google Shopping

Is it for an authority to decide when the Bronner conditions are applicable?

Interestingly, the Google Shopping decision shared the point of principle summarised above: the Bronner conditions are applicable where intervention would require a firm to ‘transfer an asset or enter into agreements with persons with whom it has not chosen to contract‘ (para 651 of the decision, which refers to Van den Bergh Foods).

More controversially, the Commission argued that the above question hinges on what the decision formally requires. The first open question is therefore whether this is an appropriate interpretation of Van den Bergh Foods and Slovak Telekom.

I have explained elsewhere why the Commission’s interpretation of the case law is not wholly uncontroversial. If it were followed, it would give a competition authority the discretion to decide when the Bronner conditions are applicable and when they are not. Insofar as it turns an issue of law into one of discretion, it does not find easy accommodation in the EU legal order.

Similarly, if one were to follow the Commission’s approach, a competition authority would be able to circumvent the Bronner conditions simply by avoiding the specification of the remedy.

As I have already argued, a more satisfactory understanding of Van den Bergh Foods and Slovak Telekom is to focus on what a decision requires in effect (as opposed to what it formally demands). This interpretation would be consistent with the role of the Court of Justice in the EU legal order and would place substance above form (a key leitmotif of EU competition law since its inception).

Do organic search results count as ‘access’ within the meaning of Slovak Telekom?

There is an important, and potentially decisive, difference between Google Shopping and Slovak Telekom. The technology behind Google’s search engine does not require the firm to deal with rivals. Accordingly, the display of Google’s generic search results involves strictly unilateral conduct (the underlying technology is explained, by the way, in paras 15-17 of the Commission decision).

In this sense, Google Shopping is different from the practices at stake in Slovak Telekom. In the latter, the provision of services by downstream rivals necessitated an access agreement between new entrants and the incumbent. In Google Shopping, on the other hand, the concerns related to the fact that comparison shopping sites only aspired to feature as ‘generic search results’ (para 344 of the decision).

Against this background, the question is whether featuring in Google’s generic search results counts as ‘access’ within the meaning of Slovak Telekom. In one sense, one could argue (as I presume the Commission and the complainants will) that it does. There are, on the other hand, reasons to take the opposite view, and claim that ‘access’ within the meaning of Slovak Telekom presupposes an agreement between the dominant firm and its rivals. These reasons are sufficiently compelling to make the issue interesting from a legal standpoint.

As explained by the Court in para 51 of Slovak Telekom, the question is whether intervention would interfere with the firm’s freedom of contract. Action under Article 102 TFEU would not interfere with such freedom where there is an ongoing contractual relationship with third parties (whether this is the result of voluntary dealing or of a regulatory obligation).

No such ongoing contractual relationship would exist, on the other hand, where the dominant firm unilaterally operates a service such as a search engine. In fact, only following intervention by the Commission in Google Shopping did the firm conclude an agreement with third parties. Which takes me to the last open question.

What about remedies that are effective alternatives to a duty to conclude an agreement?

In Google Shopping, the Commission did not specify a remedy. One may thus be tempted to argue that, even though intervention led to Google concluding agreements with third parties and granting them access to a feature it had reserved for its own use, such an outcome was not mandated by the decision. According to this view, Bronner would not be relevant. Shared access to a feature was the choice of the firm, not a requirement.

One may reach a different conclusion, however, if one considers that there is a gap in the case law, which Google Shopping exposed. Cases like Bronner and Slovak Telekom focused on one possible way in which refusal to deal cases can be remedied: by requiring the firm to provide access.

However, such cases can be remedied in two other ways, which are equally effective. First, by mandating the structural separation of the two activities (separating, for instance, the infrastructure and the services running on the infrastructure). Second, by asking the dominant firm to close a division (for instance, by no longer providing the services and merely operating the infrastructure).

Since all three remedies (mandating access, structural separation, closing down of a division) are functionally equivalent, and since they all intrude with firms’ freedom of contract and their right to property, I struggle to think of a reason why they should be treated differently from a legal standpoint.

In the same vein, one could define the scope of Bronner as follows: the indispensability and elimination of all competition conditions are part of the legal test where intervention would amount, in effect, to any of the three remedies above. Whether the remedies are spelled out in the decision would be immaterial. The relevant question would be whether bringing the infringement to an end would require, in effect, either a duty to conclude an agreement, the structural separation of two adjacent activities or the closing down of one of the activities.

I very much look forward to your thoughts on how best to make sense of Slovak Telekom, in particular if you see things differently. As you know, I have nothing to disclose.

Remedies in Google Shopping: a JECLAP symposium with Marsden and Graf & Mostyn

It is remarkable that the remedies in Google Shopping, a case that was decided more than three years ago, are still being discussed. As you certainly remember, the Commission chose a ‘principles-based’ approach that did not specify a particular way to comply with the decision.

Complainants argue, to this day, that Google’s implementation of the neutrality obligation mandated by the Commission does not respect the principles outlined in the decision.

It is against this background that the Journal of Competition Law & Economics is proud to feature a mini-symposium on the matter.

One of the papers – ‘Google Shopping for the Empress’s New Clothes –When a Remedy Isn’t a Remedy (and How to Fix it)’ – was prepared by Philip Marsden. As disclosed by Philip, the piece is a spin-off of some research he undertook for one of the complainants in Google Shopping.

The second paper – ‘Do We Need to Regulate Equal Treatment? The Google Shopping Case and the Implications of its Equal Treatment Principle for New Legislative Initiatives’ – was prepared by Thomas Graf and Henry Mostyn, who represent Google in the case (as is well known and disclosed).

The two papers are currently behind a paywall but we are looking, at JECLAP, to making them available free of charge soon.

If you ask me, the key takeaway about this debate is the very fact that it is taking place and that the remedy is still in a limbo over three years since the adoption of the decision.

Contrary to what has sometimes been suggested, this state of limbo is not a bug. It is an integral feature of proactive intervention in digital markets. Redesigning products and altering business models is complex, prone to errors, and does not have an obvious end in sight (once down this road: where to stop?).

I certainly do not see this case as a one-off or an aberration, but a sign of the challenges to come under the new competition law. As I mentioned at a conference a few weeks ago: in digital markets finding an infringement is not the end, it is just the end of the beginning.

Enjoy the papers!

NEW PAPER | Indispensability and abuse of dominance: from Commercial Solvents to Slovak Telekom and Google Shopping

Under certain circumstances, Article 102 TFEU can only be triggered if it can be shown that an input or platform is indispensable for competition on a neighbouring market. There is some controversy, however, about what these circumstances are. Sometimes (e.g. CBEM-Telemarketing, Bronner) indispensability is required; sometimes, it is not (e.g. Telefonica, TeliaSonera).

The question is so intriguing that I have written a paper on it (available on ssrn, see here). Many of you will be familiar with my take: the case law is clearer than most commentators tend to concede. As I have explained in past papers, it is all about the remedy.

Where intervention under Article 102 TFEU would demand the administration of a proactive remedy (either a structural remedy or a prescriptive obligation that necessitates monitoring), indispensability becomes an element of the legal test (and thus a precondition for intervention).

Why the remedy determines whether indispensability is an element of the legal test

Support for this position can be found in the case law. In fact, the EU courts were explicit about the point in Van den Bergh Foods. According to this ruling, indispensability would be an element of the legal test where intervention would require the firm to ‘transfer an asset or enter into agreements with persons with whom it has not chosen to contract’.

The case law makes a lot of sense. Proactive remedies are notoriously difficult to design, implement, and monitor – the experience with Microsoft I and Microsoft II is there for all to see. Therefore, it makes sense to limit to exceptional circumstances the instances in which competition law institutions (courts, authorities) are exposed to this particular stressor.

This is all the more sensible if one considers, in addition, that weighing the ex ante and ex post dimensions of competition is as difficult an exercise, if not more.

From an ex post perspective, any refusal to deal restricts competition. Why is a refusal to start dealing typically abusive only in exceptional circumstances, then? Because the ex ante dimension of competition – the counterfactual, again – also matters. In this regard, indispensability is a valuable proxy to avoid a difficult balancing exercise (even if one ignores the difficulties, mentioned above, around the design, implementation and monitoring of proactive remedies).

Implications for ‘grey area’ cases

Indispensability is a controversial issue in some pending ‘grey area’ cases. What is interesting about these is that they come across as being somewhere in between two lines of case law.

Slovak Telekom is one of these cases. Some of the practices at stake in the case were labelled as a refusal to supply. Does it follow that indispensability should be required? Not necessarily, the Commission argued. I concur with it (and the General Court, which has already examined the question).

Why? In the circumstances of Slovak Telekom, the infringement could be brought to an end without resorting to proactive remedies. The usual reactive intervention (a cease-and-desist order) was more than enough.

The issue arose again in Google Shopping. Unlike Slovak Telekom, the infringement could only be brought to an end by means of proactive remedies (in essence, a redesign of Google’s products). The difficulties that come with the design, implementation and monitoring of such measures have become apparent in the aftermath of Google Shopping (and as far as I can tell, these difficulties have not yet been solved; see here).

In Google Shopping, the Commission refers to the principle laid down in Van den Bergh Foods.

Why does it conclude that indispensability is not required? It is all about its interpretation of the principle.

Google Shopping suggests that, so long as the Commission does not formally mandate a proactive remedy, indispensability is not an element of the legal test. According to this view, if the Commission simply requires that the infringement be brought to an end, Van den Bergh Foods would not be relevant.

As I explain in the paper, I am not sure this is the most reasonable interpretation of Van den Bergh Foods, and this, for two main reasons.

First, the interpretation advanced in Google Shopping would give the Commission the discretion to decide when indispensability is an element of the legal test and when it is not.

In other words, this interpretation would turn an issue of law (the conditions to establish an infringement), subject to full judicial review, into one left to the discretion of the authority (and thus subject only to limited review).

Second, the EU courts have always placed substance above form. As a result, I fail to see how the relevance of indispensability can depend on what a decision formally requires – as opposed to what it entails in substance.

It remains to be seen whether the case law will prove resilient. The pressure to circumvent and/or abandon the consistent doctrine since Commercial Solvents is strong. I claim in the paper that, if the case law is to survive, the underlying principles would probably have to be spelled out more clearly.

Before I forget: I am delighted to clarify that, in accordance with the ASCOLA declaration of ethics, I have nothing to disclose.

I really look forward to your comments!

Google Shopping Decision- First Urgent Comments

Today is an important day for EU competition law. For various reasons I have not commented publicly on Google’s cases for over two years now (for our previous extensive coverage, see here) The most recent of those reasons is that whereas I used to be a neutral observer (like Pablo still is) I have recently started advising Google in some competition matters, although as of today not directly on the Shopping case.

Today seems like an appropriate day to break that silence. Pablo and I were both invited by CCIA to participate in a press briefing call in which we explained the case and gave our views about it to a bunch of journalists. In anticipation of that call I hastily drafted the urgency thoughts that are the basis of this post. By the way, Pablo and I will again be speaking about this case on 11 July at this forthcoming Queen Mary University of London event, and, for the sake of neutrality, he will be the one covering the case here and elsewhere afterwards.

DISCLAIMER: Before you continue reading, please bear in mind that, even if I’m not working on this case, and even if my views have not changed, I am certainly not neutral (as I once was). So please take what I say with as many pinches of salt you wish and judge it only by its merits. To be sure, my preliminary opinions might very well not coincide with Google’s, as it may have other views and certainly has other lawyers who will surely have more views.

What the case is about

The case is not about manipulation or skewing of organic search results, as some have wrongly stated. It is about the display of product results and product ads. And it is only about the so-called comparison shopping market, of which most EU consumers had probably never heard about. The very assumption that such a market exists is far from straightforward, but there are other more profound and far-reaching concerns that we will try to very quickly outline in this post.

Google provides a free search service to consumers and it monetizes this service via advertisements. Today’s decision states that Google cannot favor its own product ads –the very same ones that make its services possible- over those of competitors. This is remarkable and wholly unprecedented.

To illustrate what this means, a useful analogy may be to think about a newspaper (a business models that is also funded via ads). What the Commission is doing is the equivalent of asking this newspaper to carry/publish the advertising service of competing newspapers and in equal conditions whatever that means (same placement, length or size, possibly even almost for free) and without getting the revenue. Another valid analogy is that of a supermarket obliged not to favor its own products, even if it is not the only supermarket around. The implications for vertically integrated companies in virtually every industry are potentially enormous.

Searching for the harm

Searching for the harm to competition and consumers is particularly challenging here. The Commission stated today that Google deprives consumers of choice to buy and compare prices online. That is the very fundamental idea at the foundation of the case. In my view, however, consumers could hardly have more choice when it comes to comparing prices and buying online. Whatever Google does cannot affect that. If you now want to buy any product you can search in Google, but you can also do so via apps, all merchant sites, platforms like Amazon, ebay, visit directly price comparison websites, outlets like Zalando, etc. Consumers have choice within Google and outside of Google. Even if Google price comparison results are more visible on a Google site, there is nothing precluding consumers from visiting any other site.

Tellingly, the Commission is indeed not claiming that there is direct harm to consumers but only assuming that somehow consumers will suffer from a decrease of traffic of price comparison websites even if the latter are not foreclosed. The Commission is thus equating any sort of alleged competitive advantage or disadvantage with anticompetitive effects; in my view, this is a very loose notion of consumer harm and a very long shot.

The facts and the evidence

In order to build this case the Commission focuses on a very small number of shopping comparison sites (aggregators) and concludes that they constitute a relevant market of their own. In my personal opinion this is quite counterintuitive and problematic. First, because it ignores hundreds of other aggregators. Second, because it also ignores that consumers do not only buy online through price comparison sites; indeed, the decision remarkably ignores the role of merchant platforms that also enable consumers to compare prices and buy. The players active in online sales, be it Google, Amazon, ebay, Zalando, any store or any individual merchant or manufacturer all face fierce competition. Third, the decision ignores that even if Google’s results enjoyed better display, consumers are not locked in, they can and do visit other websites other than Google before buying on the internet. The Commission says there is a link between visibility in Google and number of clicks received, but, again, this ignores the fact that consumers do not just buy online via Google. Even if Google’s results were more visible, there is nothing precluding consumers from visiting another site. There are certainly no technical or economic barriers for that, and this is what matters according to the most recent case law Third, and importantly, the Commission’s concern in this case is that some price comparison websites have lost traffic. In that case the Commission would have to prove with convincing evidence that this loss of traffic is due to Google’s display of product ads. This is certainly not easy, as there are many other more plausible, and indeed more likely, explanations (like the fact that consumers now prefer to buy directly on the merchants’ sites, in apps or in other platforms). The UK High Court and Justice Roth understood this perfectly in the Streetmaps Judgment with regard to a very similar theory of harm (see here).

The Law

But what I mostly care about is the law. Commissioner Vestager –whom you know is well-liked by this blog- explained today that DG Comp has reviewed 5.2 Terabytes of information. I do not doubt for a second that the smart people in the case team dealing with the case worked hard and thoroughly, but 5.2 Terabytes of information is meaningless if the law is then discussed quickly in just a few paragraphs and if the legal test is wrong.

From a legal standpoint, this case is unprecedented; there has never been a case like this, in Europe or anywhere else, and the implications are incredibly far-reaching. This is perhaps why for many years the Commission tried to avoid an infringement decision and rather preferred to settle with Google.

The first reason why the case is unprecedented is because it establishes the principle that a company may not favor its own services over those of competitors. Companies everywhere –dominant or not- logically favor their own services when they buy and sell goods or services even if this does not result in foreclosure. Vertical integration is everywhere, and it is in the very nature of multi-sided platforms. Hampering their ability to promote their services (in spite of no evidence of rival foreclosure) implies not allowing them to decide how to best provide their services. Legally, a firm can only be obliged to deal with or assist competitors when this is indispensable for competition to exist in a different market. This is the test that has consistently been used in EU Law. But the Commission considers this case law not to be applicable and wants to extend the scope of the law. The implications are incredibly far-reaching (actually, I think I said that already…)

Indeed, the Press Release suggests that the Commission does not argue indispensability, but merely that Google grants itself a convenient advantage. So the Commission does not label Google as an essential facility (because that would be pretty hard to do given the high legal standard), but it does treat Google as if it were, thus bypassing that legal standard. I fail to see how what is the logic or consistency of this reasoning against the backdrop of the relevant case law. In my view, and not having yet read the decision, this suggests a possible bypassing of established legal rules and standards with ad-hoc case specific theories and remedies, thereby risking turning the prohibition of abuses of dominance into the realm of the arbitrary.

The second reason why the case is unprecedented is because the alleged abuse is at its core a product improvement. The combination of specialized and general results (what Google is accused of) is something that is also done by other search engines, including Microsoft’s Bing and Yahoo! Everyone does it because it is best for users to get a direct response (if you search for an address, you get a map; if you search for a product, you are taken directly to the product, not to another intermediary). A product improvement that disadvantages rivals is not anticompetitive. Or at the very least one would have to trade off pro and anticompetitive effects, which is something that I very much doubt the Commission has done, essentially because no one knows how to do it. And in the face of doubt a sanction is not appropriate. This wall very well explained in Streetmaps and it was understood by all other competition authorities who have had the chance to examine these practices.

The remedy

The Fine: The Commission has imposed today the largest fine ever imposed on a single company doubling the previous record. What is remarkable is that this fine has been imposed after years of negotiating commitments (which are only possible in cases where “the Commission does not intend to impose a fine”), in relation to conduct that had never been found unlawful, that is actually considered lawful in other jurisdictions, that no lawyer would have anticipated to be unlawful and that takes place in a relatively small and competitive market. In previous cases, the Commission declined to impose a fine when its case was novel and had no precedents. This is actually the first case in which conduct that was found suitable for a commitment decision receives a fine (see the Motorola/Samsung and Mastercard/Visa precedents).

Future compliance: I do not know how this is framed in the decision. The Commission has stated today that it has not given any precise indications and that it is up to Google to come up with a solution that does not have the same effect.

In competition cases remedies need to fit the Commission’s theory of harm. In this case, however, there is no clear remedy fitting the unprecedented theory set out in the decision. Having ordered a remedy in the decision would have probably exposed the flaws in its reasoning. Possibly to avoid that risk the Commission has stated that it is up to Google to craft a remedy that is neutral –whatever that means- and that removes the problem. I preliminarily see two problems here:

- The first is, how can Google remove effects that it arguably did not cause in the first place? If Google is right and the loss of traffic on the part of the companies considered by the Commission is attributable to something other than Google’s conduct, how can Google fix that? And how can the Commissioner assess whether the remedy is effective? It would seem as if the Commission were requiring Google to artificially maximize the traffic received by some specific category of its rivals (price aggregators) which certainly would not be neutral.

- The second problem is wider. The Commission says whatever Google does must be neutral, but it does not define what neutral means. This undefined notion is particularly problematic when applied to a business which by definition has to rank search results.

Admittedly, Google could simply decide to shut down the service and not offer product results in Europe. This would be perfectly plausible and legal, and is actually what Google did with Google News in Spain back in the day, only to show that this benefited no one.

Effect on other Google products.

The Commission has stated that this decision is now a precedent and the starting point to look at other Google’s services. Firstly, this implicitly means that there was no earlier precedent and thus confirms the novel nature of the case. Secondly, the Commission could have run a case comprising all verticals, but it didn’t, and it must be because it thought this was the easiest to run for some reason. That may have to do with market definition, or because evidence in other verticals did not match the theory. If the Commission decided not to run those cases, it must be for a reason. My personal view is that this technique of picking the preferred sample to then extrapolate results would not be an acceptable shortcut.

Conclusion. In order to make this case possible the Commission first had to change the stance it held for years during the commitment negotiations and now has had to craft a new legal theory without clear legal foundations, prohibit a conduct validated in every other jurisdiction, assume dominance against the indications of the case law, define a relevant market ignoring the main actors active in online shopping, ignore the fact that consumers are not locked-in Google, assume that the loss of traffic of some specific companies is due to Google not considering other plausible scenarios and avoid spelling out a remedy. In my non-neutral view, it is a remarkable decision indeed.

What to make of the fresh charges against Google

The Commission is making a habit of sending Statements of Objections to Google. There should be little doubt that Google has become the most emblematic saga of the decade (and one cannot exclude at this stage that it will also dominate the coming one). Yesterday, it brought additional charges relating to the Search case and fresh ones concerning its ‘AdSense for Search’ platform. Neither of the two moves is particularly surprising, as they have been expected for a while. Yet they reflect very well the current trend and the remaining open questions. ‘How many more Statements of Objections?’ is of course the one that springs to mind immediately. I can also think of the following:

All Google-related cases are essentially variations on the same theme: When reading about the AdSense case, it became pretty clear to me that it raises the same fundamental issue as Google Search and Android. The question is whether – and why – it is an abuse for an integrated firm to favour its own activities. The case law does not support the idea that dominant firms are bound by a general duty of non-discrimination. Thus, the Commission will have to articulate a coherent legal test and to explain how its interpretation of Article 102 TFEU is consistent with prior case law and its overall approach to the enforcement of the provision.

Clarity in this sense is indispensable, as the positions hinted at by the Commission in the press release are potentially far-reaching. For instance, they suggest that a TV channel could be abusing its dominant position by keeping its advertising space and revenues for itself, or that supermarkets may be bound by a duty of non-discrimination when placing goods on their shelves.

The industry has changed a great deal since 2010: The Google Search case has been going on for a very long time. This is always dangerous in EU competition law, and even more so in dynamic industries. It is obvious that end-users’ habits have changed a great deal since 2010. Firms’ behaviour and strategies have also changed. As the press release shows, this is something that promises to be contentious in the case. Amazon and eBay look more like price comparison websites. And Google Shopping looks more like them. As a result:

- The credibility of the case depends, by and large, on market definition: If one assumes that Amazon and eBay compete with Google on the same market, the Google Search case certainly sounds far less problematic. Can one credibly argue that Google’s practices are an issue where it faces rivalry from two giants? Unsurprisingly, the press release refers to this point of contention. The Commission acknowledges that the market may be broad enough to encompass Amazon and eBay. Still, it believes that these two firms do not compete with price comparison sites. In any event, it clarifies, Google’s practices would still be abusive under a broad definition of the market.

- It is not clear that there is a causal link between Google’s practices and the abuse claims: When the industry changes significantly during a period of time, the exclusion of some firms may very well be the natural consequence of the evolution of the market. In Post Danmark II, the Court emphasised that Article 102 TFEU applies where the effects are ‘attributable’ to the dominant firm, that is, where there is a causal link between the practice and the alleged effects.

Irrespective of how the market is defined, the Commission would have to show, accordingly, that the alleged decline of some price comparison sites is the consequence of Google’s behaviour, and not the consequence of the rise of Amazon and eBay and/or of changes in end-users’ behaviour. You will certainly remember that this is where Streetmap failed. Mr Justice Roth concluded that the decline of that firm would have happened anyway, and was not attributable to Google.

Is Google Search an object or an effects case?: I wrote last year that it was not entirely clear to me whether Google’s practices were deemed abusive by their very nature or only insofar as they are likely to have exclusionary effects. The issue is not any clearer after reading yesterday’s press release. Google’s practices have been under investigation for so long that we should know by now whether they had exclusionary effects. But maybe this fact does not really matter that much.

There are references to exclusionary effects in the press release, of course, but I am not sure that they are decisive. Bloomberg echoes the statements made by the Commissioner, which suggest that what really matters is the fact that Google discriminates in favour of its own services, and that evidence in this sense may point to a broader ‘pattern’. If Google Search is indeed being pursued as an object case, what I wrote above is irrelevant. A ‘by object’ approach could allow the Commission to start new cases (concerning travel and local search, for instance) very soon. Which is, I understand, exactly what the Commissioner has suggested.